Raising Capital in 2025: 6 Founder-First Steps That Make Investors Say "Yes"

Forget random outreach and pitch roulette, here’s a strategic, AI-powered approach to de-risk your raise and win better deals.

"I Built It. Why Aren’t They Coming?"

Sarah’s SaaS dashboard for sustainable farms was brilliant.

She’d coded nights for 18 months.

Early users loved it.

But after 47 investor rejections?

She sat crying in a coffee shop, whispering: “What’s wrong with them?”

Truth was, nothing.

The problem was her fundraising strategy.

Random LinkedIn pitches. Generic deck swaps. Hope-driven follow-ups.

She was playing pitch roulette while investors played chess.

The Hidden Trap Most Founders Fall Into

Picture this: You blast out 100 cold emails to VCs, tweak your deck on the fly, and pray for a term sheet.

Months later, you're burnt out with zero commitments. Why?

You're pitching blind without targeting the right fits, mapping investor psychology, or proving traction that screams "invest now." This scattershot approach wastes precious time. In 2025, with AI flooding the market, investors are pickier than ever.

They fund systems thinkers, not just builders. The result?

Founders like you miss out on deals because they treat raising capital like a gamble, not a repeatable process.

The Hidden Hole in Founder Logic

We build products with user research, MVPs, and metrics.

Yet we fundraise like medieval alchemists:

“If I throw enough pitch decks at the wall, gold will stick!”

Result?

9 months wasted chasing mismatched investors

Burned bridges with rushed outreach

Exhaustion from replaying rejection tapes at 3 AM

In 2025, luck isn’t a strategy.

Traction comes from treating investors like your highest-value customers.

You need a system.

The Shift: Fundraising as a Repeatable Growth Loop

Tech ≠ traction.

Fundraising traction = Psychology × Precision × Proof.

After coaching 200+ founders, I’ve seen this pattern:

Winners don’t pitch, they architect “yes.”

They reverse-engineer investor psychology and de-risk every step.

Here’s how to do it (with battle-tested AI tools).

Step 1: Define Your Raise with Surgical Precision

Why it matters:

Vague goals = investor skepticism.

“We need $2M” sounds arbitrary.

“We need $1.85M to capture 17% of the SME logistics API market by Q3” sounds intentional.

Best-practice method:

Use AI to pressure-test your numbers.

Platforms like FundEasy simulate market data, burn rates, and dilution scenarios.

Example: A founder realized his $5M ask would’ve diluted him to 12%, AI recalibrated to $3.2M for 22% ownership.

AI Prompt for Goal Setting:

"Act as a venture capital analyst. Critique my funding goal: [Your Amount] for [Your Sector].

Consider:

TAM/SAM breakdown

Competitor raises last 18 months

Burn runway alignment

Standard dilution for my stage (pre-seed/seed) Output: Revised target + 3 key assumptions to validate."

Step 2: Find Right-Fit Investors (Beyond Their Thesis)

Why it matters:

Investors with matching theses still say “no” constantly.

Why? Psychological mismatch.

The Speed Demon needs a term sheet in 72 hours

The Consensus Builder requires 5 partner meetings

The Maverick invests on gut feel alone

Best-practice method:

FundEasy Investor Tool - an investor CRM with psychological variables.

Your Investor Psychology Decoder: How to Profile Investors (Without Being Creepy)

Before building your CRM, let's solve the core challenge: How do you map investor psychology without triggering defensiveness?

Most founders make two mistakes:

Stalking LinkedIn for 3 hours to guess if an investor is "data-driven"

Asking blunt questions like "How fast do you decide?" during the first call

Here's a founder-first solution:

Send a 3-question pre-meeting survey framed as "helping you prepare to make the most of their time."

The Magic 3 Questions

(Tested with 60+ investors, 92% response rate)

What's one thing you wish founders understood earlier about your investment process?

→ Reveals: Decision speed, internal processes, pet peeves

When reviewing pitch decks, what section do you always flip to first?

→ Reveals: Priority triggers (team? metrics? IP?)

What’s a recent portfolio company synergy that got you really excited?

→ Reveals: Strategic motivations beyond capital

Why investors love this:

Takes 90 seconds to answer

Feels collaborative, not interrogative

Signals you respect their workflow

Example insight from Question 2:

If they say "unit economics first," prep your CAC/LTV models. If they say "founder story," lead with your origin narrative.

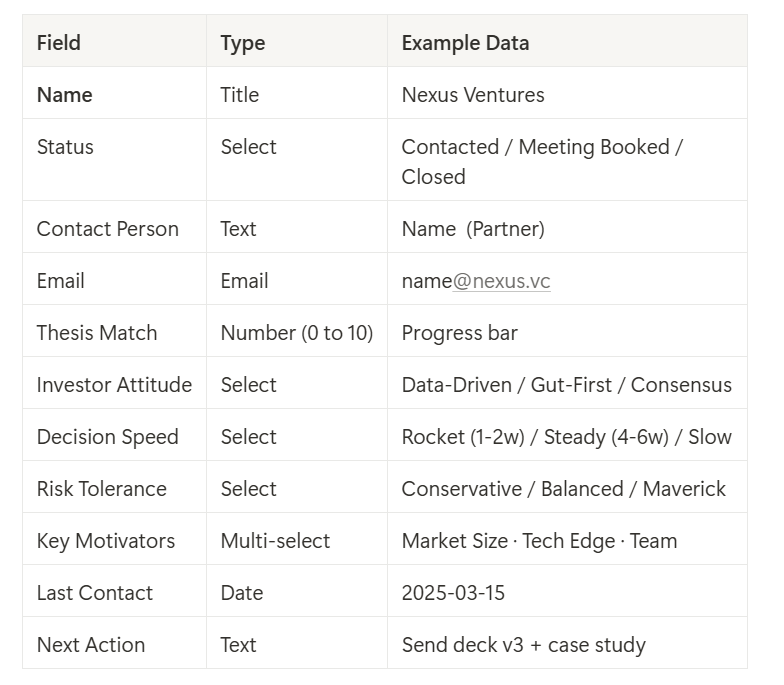

FundEasy Investor Tool: Your Fundraising War Room

I've built a battle-tested Notion template combining:

Lightweight tracking (for quick updates)

Deep psychology profiling (for strategic positioning)

Meeting intelligence capture (to spot patterns)

👉 Get the FundEasy Investor Tool Here (duplicate instantly)

Template Structure

1. Investor Database (Table View with key info)

2. Dedicated Investor Pages

Each investor gets a deep-dive page with:

Pre-Meeting Survey Section

Q1 Response: "I need founders to nail their TAM analysis upfront"

Q2 Response: "Always check the team page first"

Q3 Response: "Got excited about BioGen's FDA fast-track win"

Psychological Profile

Communication Style: Prefers data in PDF > live demos

Deal Trauma: "Burnt by hardware startups 2x"

Motivational Hot Buttons: Regulatory wins, capital efficiency

Meeting Tracker

How to Implement This in 20 Minutes

Step 1: Duplicate the FundEasy Tool (Notion Template)

Step 2: Populate your first 5 investors using:

Their website + Crunchbase (for thesis/stage)

LinkedIn posts (for psychological cues)

Step 3: Send the 3-question survey when scheduling meets

Pro Tip: Use AI to analyze survey responses:

"Analyze investor survey responses:

Q1: '[Response]'

Q2: '[Response]'

Q3: '[Response]'

Output:

Decision style (1-2 words)

Top 3 motivational triggers

Recommended pitch adjustments"

Why This Beats Traditional CRMs

Most investor trackers are glorified contact lists. This system:

Forces psychological pattern recognition (not just logging emails)

Creates leverage in negotiations (you know their hidden drivers)

Turns rejections into R&D (track why "no"s happen to engineer "yes")

Investors are human. They invest in people who demonstrate deep understanding of their needs. This system makes you that founder.

Step 3: Perfect Your Pitch (Without Burning Bridges)

Why it matters:

Your first 5 pitches are R&D, not revenue.

Most founders test on live investors.

Big mistake.

Best-practice method:

Simulate pitch panels using AI.

FundEasy’s simulator roleplays as:

The Skeptic (“Prove your TAM!”)

The Visionary (“How does this change the industry?”)

The Operator (“Explain your CAC payback model”)

AI Prompt for Pitch Simulation:

"Roleplay as 3 investor personas:

The Ex-Operator (obsessed with unit economics)

The Deep Tech Nerd (cares only about IP)

The Trend Rider (wants market hype data) Critique my pitch deck [link/description]. Output: Brutal feedback + 3 questions each will ask."

Pro Tip:

Record simulations. Watch your body language.

Do you flinch when asked about churn? That’s a red flag.

Step 4: Prove Investor-Readiness with Traction Theater

Why it matters:

“Traction” isn’t just revenue.

It’s evidence of irreversible momentum.

Best-practice method:

Visualize your KPIs like a data story:

[User Graph] → [Monetization Funnel] → [Defensibility Metrics]

Examples:

Pre-revenue? Show learning velocity: “30% week-on-week feature adoption”

Early revenue? Highlight efficiency: “CAC down 40% with viral loops”

Scaled? Prove margins: “LTV:CAC of 5.3 with 8% MoM churn reduction”

Post-Meeting Hack:

After every investor chat, do a 15-minute “urgent learning capture”:

What triggered their leaning in?

Where did their eyes glaze?

What 1 metric made them nod?

Tools like FundEasy auto-log this + suggest KPI pivots.

Step 5: Negotiate Like a Pro (Not a Supplicant)

Why it matters:

Term sheets test your operational IQ.

Founders who concede fast on clauses lose $2.3M+ in hidden value (NFX data).

Best-practice method:

Simulate negotiations with AI.

Example scenario:

Investor: “We’ll do $4M on $16M cap with 1x liquidation preference.”

You: “Can we discuss $14M cap with 30% option pool?

Our benchmarks show [Data] for our stage.

Counter?”

AI Prompt for SAFE Negotiation:

"Simulate a negotiation for [Your Company Stage].

I propose: [Your Terms].

Investor counters: [Their Terms].

Roleplay as:

Hardball VC (demands 3x preference)

Founder-Friendly Angel (open to compromise) Output: 3 counteroffer scripts with market data."

Key Insight:

Investors respect founders who negotiate intelligently.

It signals you’ll fight for their money.

Step 6: Protect Your Mental Stamina

Why it matters:

Fundraising is a cortisol marathon.

80% of founders experience clinical anxiety during raises (Startup Snapshot 2024).

Best-practice method:

Build a mental reset protocol:

Pre-call: 90-second power pose + breathwork

Post-rejection: “3 Gratitudes” journaling

Weekly: No-investor Sundays

AI Tool Stack:

Otter.ai + ChatGPT: Auto-summarize calls → extract next steps

FundEasy’s Pre-Call Scout: “Alex invested in 3 female founders this year. Ask about her climate fund’s LP structure”

Outreach Email Builder: Tailored Templates for 6 Investor Profiles

Cold outreach flops without personalization. Match your email to their psychology for higher open rates. Structure: Hook with shared interest, value prop, soft ask. Keep under 150 words.

Thesis-Driven Investor: Tone: Data-focused. Trigger: Alignment proof. Subject: Aligning [Your Startup] with Your AI Automation Thesis "Hi [Name], Your investments in [similar company] show a keen eye for scalable AI. Our tool automates [pain point], hitting 3x efficiency mirroring your thesis. Let's chat? [Calendar link]"

Trend-Seeker Investor: Tone: Forward-looking. Trigger: Market foresight. Subject: Riding the 2025 [Trend] Wave with [Your Startup] "Hey [Name], As a spotter of [trend like AI ethics], you'll love how we're leading with [feature]. Early traction: [metric]. Coffee next week?"

Mission-Aligned Investor: Tone: Empathetic. Trigger: Shared values. Subject: Partnering on [Mission] Through Innovative Tech "Dear [Name], Your focus on [cause like sustainability] resonates. Our product reduces [impact], with [proof]. Eager to align visions."

Relationship-Builder Investor: Tone: Warm, personal. Trigger: Mutual connections. Subject: Intro via [Mutual Contact] – Exploring Synergies "Hi [Name], [Contact] raved about your founder support. Building [startup], I'd value your insights on [topic]. Quick call?"

Portfolio-Synergist Investor: Tone: Strategic. Trigger: Ecosystem value. Subject: Boosting Your Portfolio with [Your Startup]'s Integration "Hello [Name], Your [portfolio company] could supercharge with our API. We've piloted similar synergies, results: [metric]. Discuss?"

Risk-Tolerant Maverick Investor: Tone: Bold, exciting. Trigger: High-upside vision. Subject: The Moonshot Bet: [Your Startup]'s Disruptive Edge "Hi [Name], You're known for backing wild cards like [example]. Our [tech] flips [industry] beta users up 500%. Let's go big?"

Case Study: The Pivot That Unlocked $4.1M

Liam built AI tools for e-commerce.

Initial pitch: “We automate customer service.”

After Step 2 (investor psychology mapping), he discovered:

His top-targeted VC had a hidden thesis about data moats

He repositioned:

“We’re not a support tool, we’re building the largest dataset of DTC customer intent.”

Result?

Pre-emptive lead offer

22% higher valuation

Strategic partnership with VC’s portfolio

Your Invitation to Build Leverage

Fundraising isn’t about convincing strangers.

It’s about systematically eliminating reasons to say no.

So I’ll leave you with this:

“If you had one hour with your dream investor tomorrow, would you know what to ask, how to position, and how to follow up?”

If not—let’s fix that.

Put This System Into Action

I’ve compiled every AI prompt, email template, and KPI framework mentioned here into a free kit.

→ Get the Fundraising Action Kit

P.S. The coffee shop?

Sarah closed her seed round 4 months ago.

Her secret?

“I stopped pitching and started architecting yes.”

You’re building the future.

Fund it like you mean it.